Geoeconomic Briefing No.176 February 1, 2024

Japanese firms seek political stability and stronger alliance: survey

– IOG Survey Results of 100 Japanese Companies on Economic Security –

Visiting Senior Research Fellow

COO, LLC future mobiliTy research

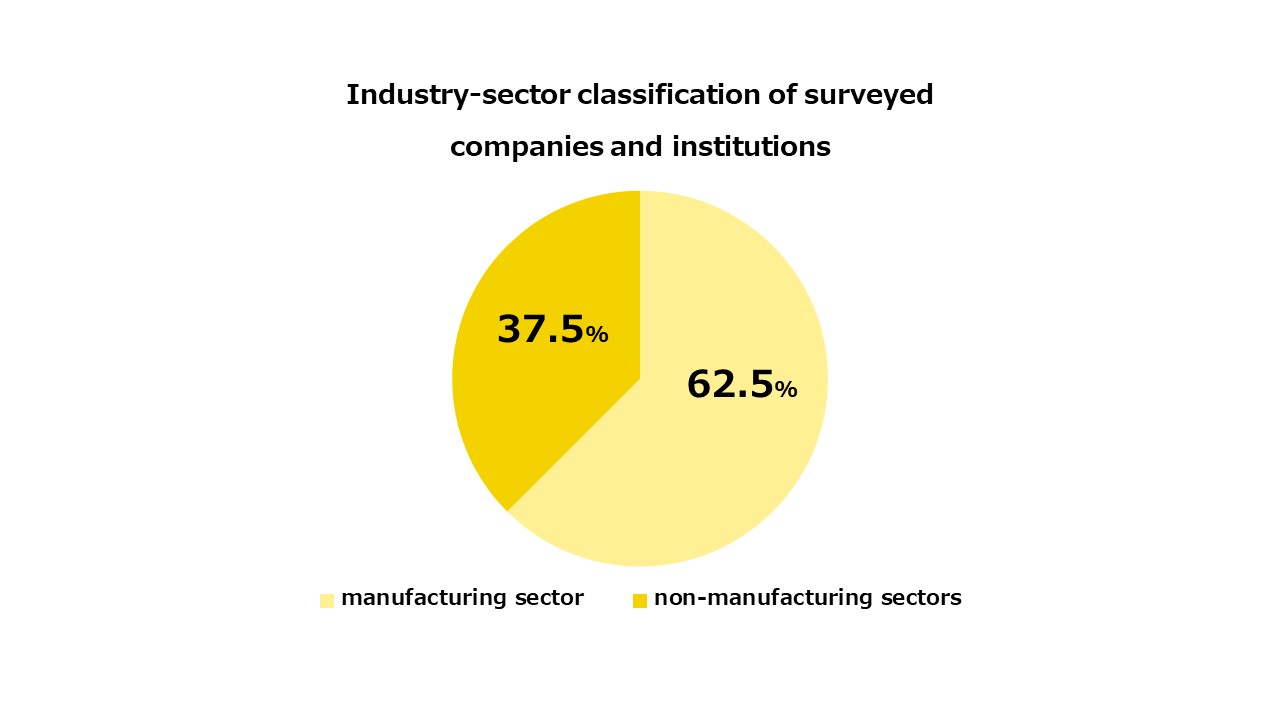

Japanese companies’ strategic stance toward the domestic, U.S. and Chinese markets became clearer in 2023 amid growing uncertainty over the U.S.-China rivalry and Japan’s enactment of the Economic Security Promotion Act. Japanese firms have shown a clear “return” of emphasis on bilateral Japan-U.S. relations and a strong desire for stable and predictable political leadership on both sides of the Pacific. This trend became apparent in a survey on economic security conducted from October to December by the Institute of Geoeconomics. Eighty companies responded to the survey.

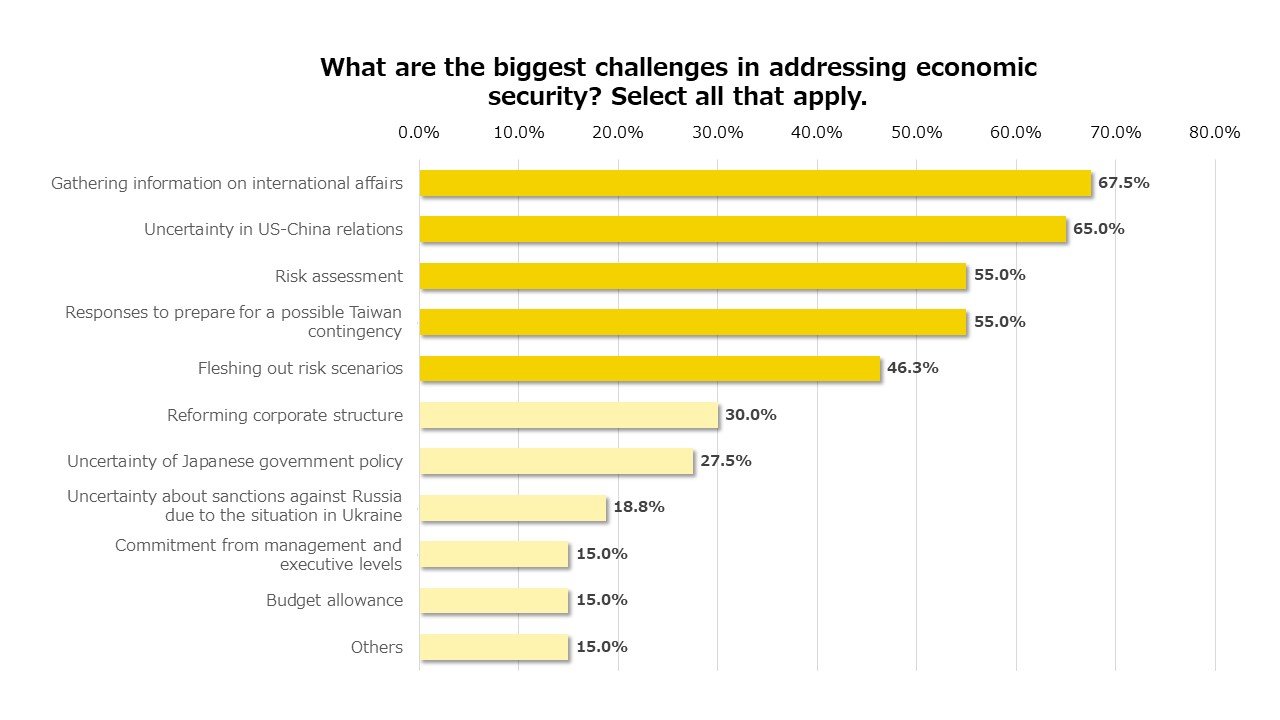

The survey, the third of its kind following those in 2021 and 2022, was conducted by sending a questionnaire in late October to a total of 107 companies, including seven newly selected firms, that the institute believes play an essential role in national economic security and are susceptible to changing economic security dynamics. Asked what the biggest challenges in addressing economic security were, it was noteworthy that the percentage of firms that thought uncertainty of Japanese government policy was a challenge dropped to 27.5% from 40.7% the previous year.

Meanwhile, a majority of companies said intelligence on international affairs and uncertainty in the U.S.-China relationship were top concerns, the same trend as last year. The percentage of firms that cited a possible Taiwan contingency rose from 50.6% to 55%. And half of the companies surveyed chose the two newly created choices — the method of risk assessment and fleshing out risk scenarios — as challenges, reflecting the Russia-Ukraine war that continues to affect firms’ business activities.

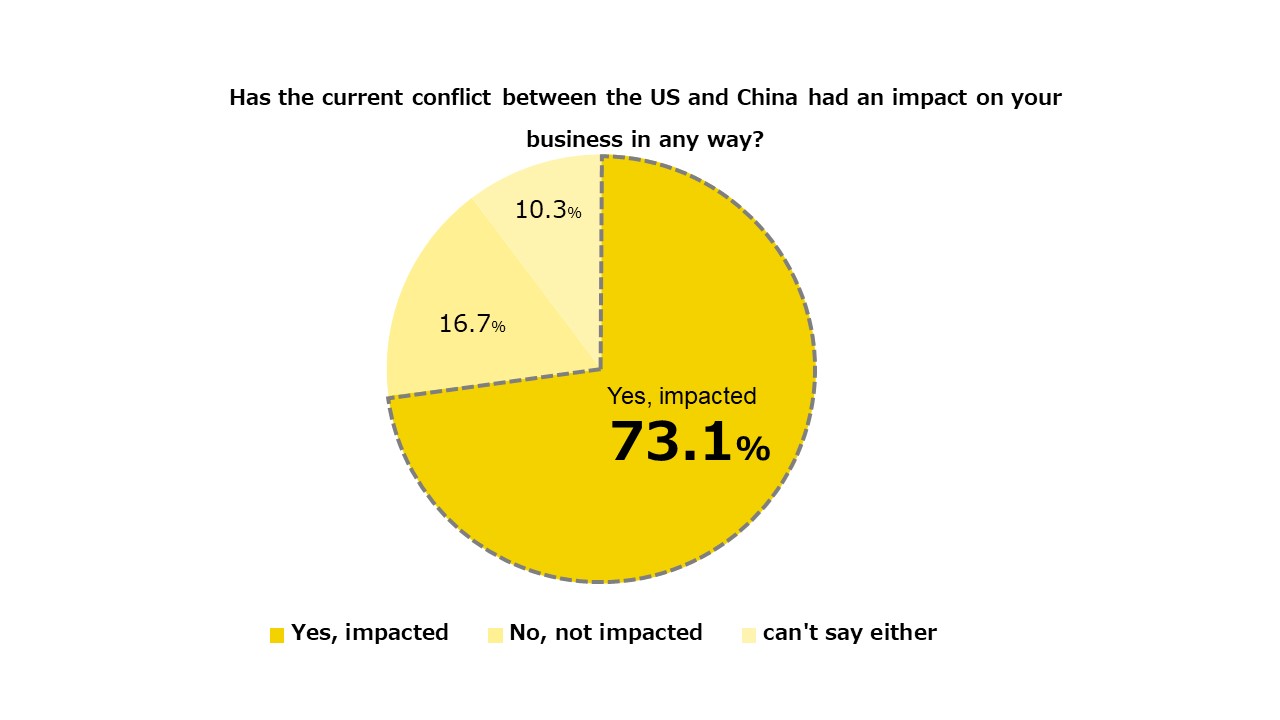

U.S.-China tensions

Uncertainty over the U.S.-China relationship has constantly been a key factor of the survey since 2021. In asking whether confrontation between Washington and Beijing had an impact on business, an option of “Can’t say either way” was newly created for the latest survey in addition to “Yes” and “No.” More than 70% of respondents said they had been impacted, up by nearly 10 points from a year earlier.

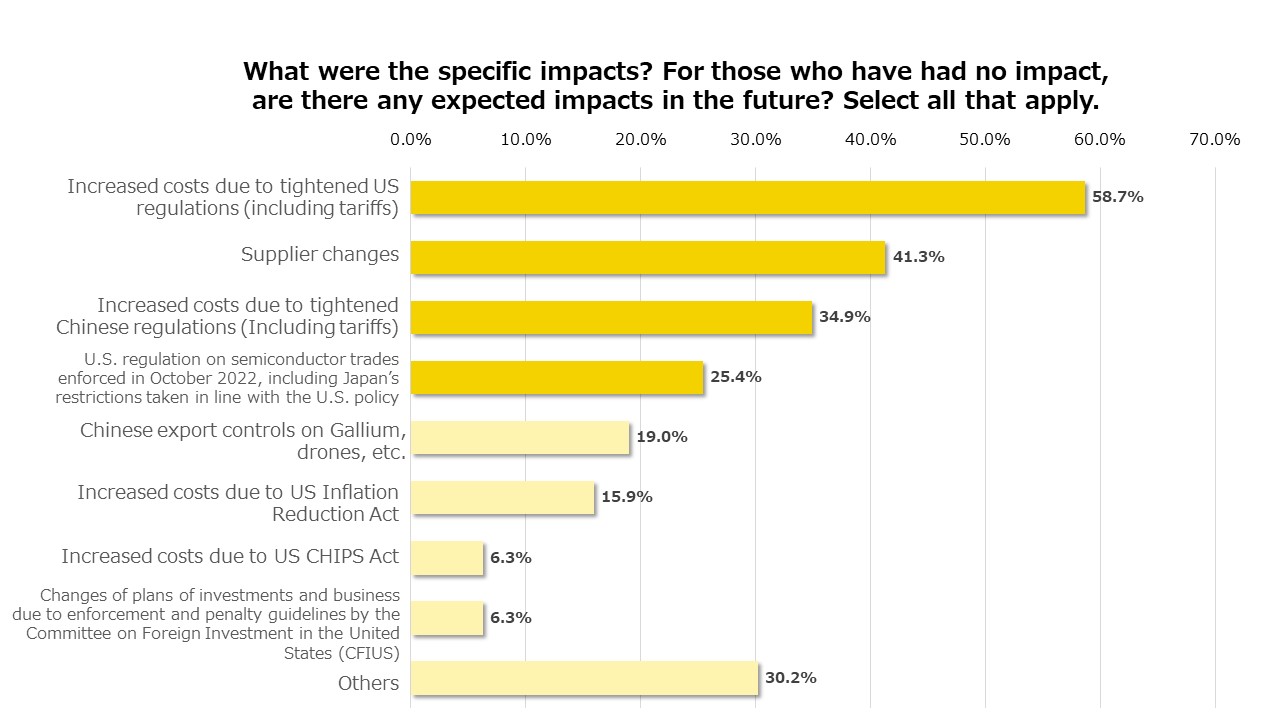

As for the specific impact of the confrontation, the top three answers were the same as 2022: fluctuation in costs and sales due to tightened U.S. regulations (including tariffs), down from 65.6% in 2022 to 58.7%; supplier changes, up from 37.7% to 41.3%; and fluctuation in costs and sales due to tightened Chinese regulations (including tariffs), up from 32.8% to 34.9%.

It has been the case since the 2021 survey that uncertainty over the U.S.-China relationship derives more from the former than the latter. In the latest survey, four recently implemented regulations on economic security adopted by Washington were newly included in the list of choices. The largest percentage of firms said they were impacted by the U.S. regulation on semiconductors enforced in October 2022, including Japan’s restrictions taken in line with the U.S. The second-largest percentage of firms said they were affected by the U.S. Inflation Reduction Act (IRA) of 2022, followed by the U.S. Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act of 2022.

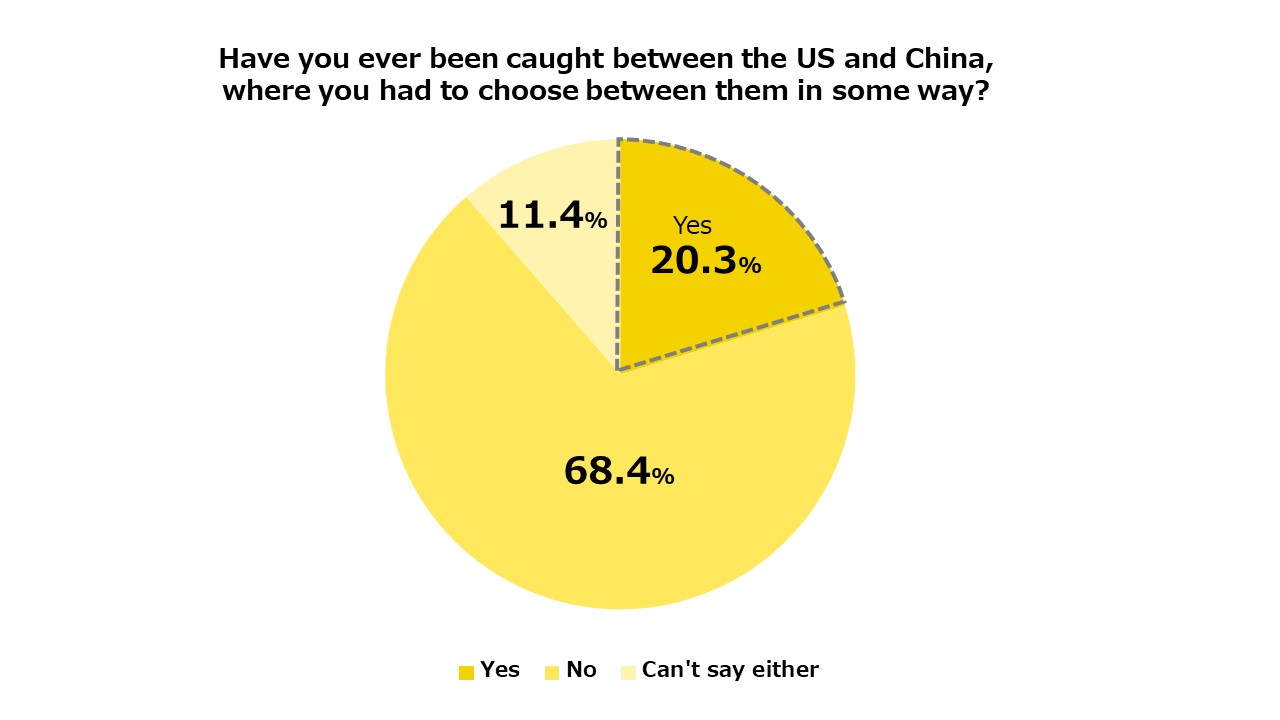

Last, but not least, Japanese companies said they had to change their investments and business plans due to the Committee on Foreign Investment in the United States (CFIUS)’s enforcement and penalty guidelines on foreign investments in U.S. firms issued in October 2022, also restricting overseas investments. While the percentage of firms that have actually been caught up in the rivalry between the U.S. and China is still small, the proportion reached 20.3%, up by 4 percentage points since 2022, suggesting that Japanese firms will have to take some sort of measures in the future to cope with the situation.

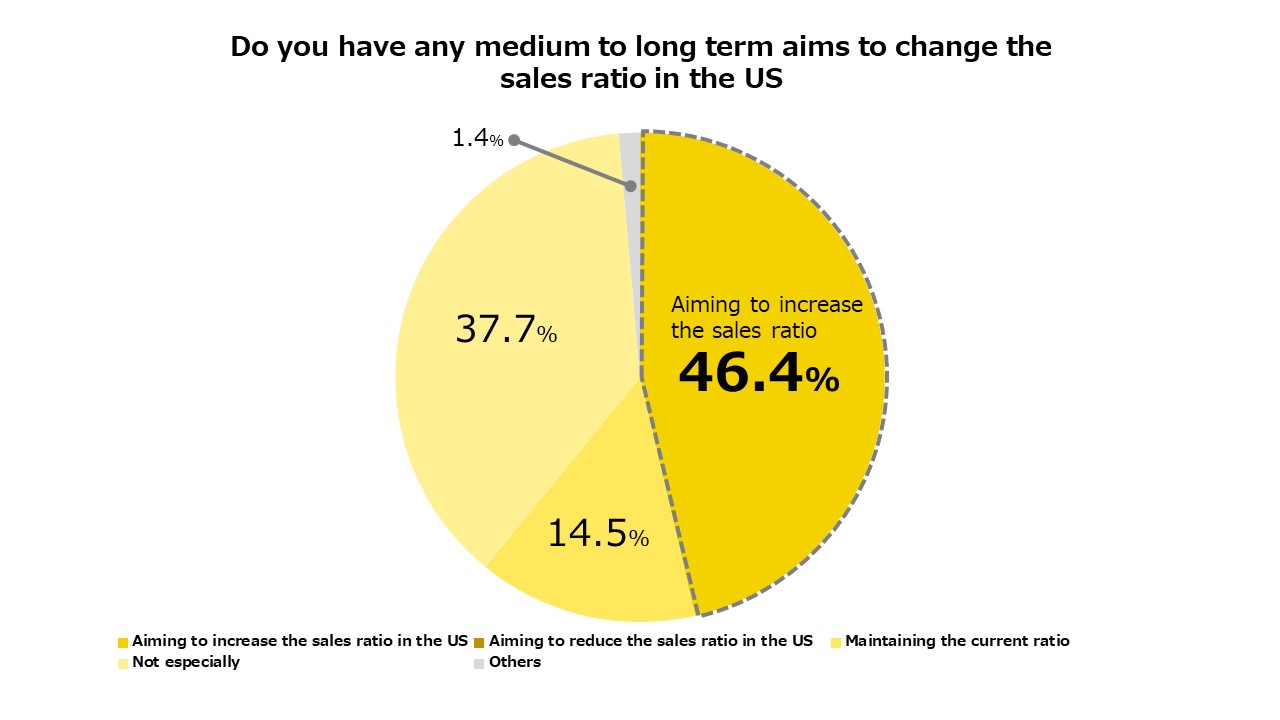

Although concerns remain regarding the business environment in the U.S., the percentage of firms with a medium- to long-term goal of increasing their proportion of sales in the U.S. marginally rose from 43.5% to 46.4%. One in two firms are continuously positive on expanding their share in the U.S. market.

The U.S. presidential election scheduled for November is attracting the attention of Japanese firms, with half of respondents saying they are focusing on related developments and the impact on their business in the U.S.

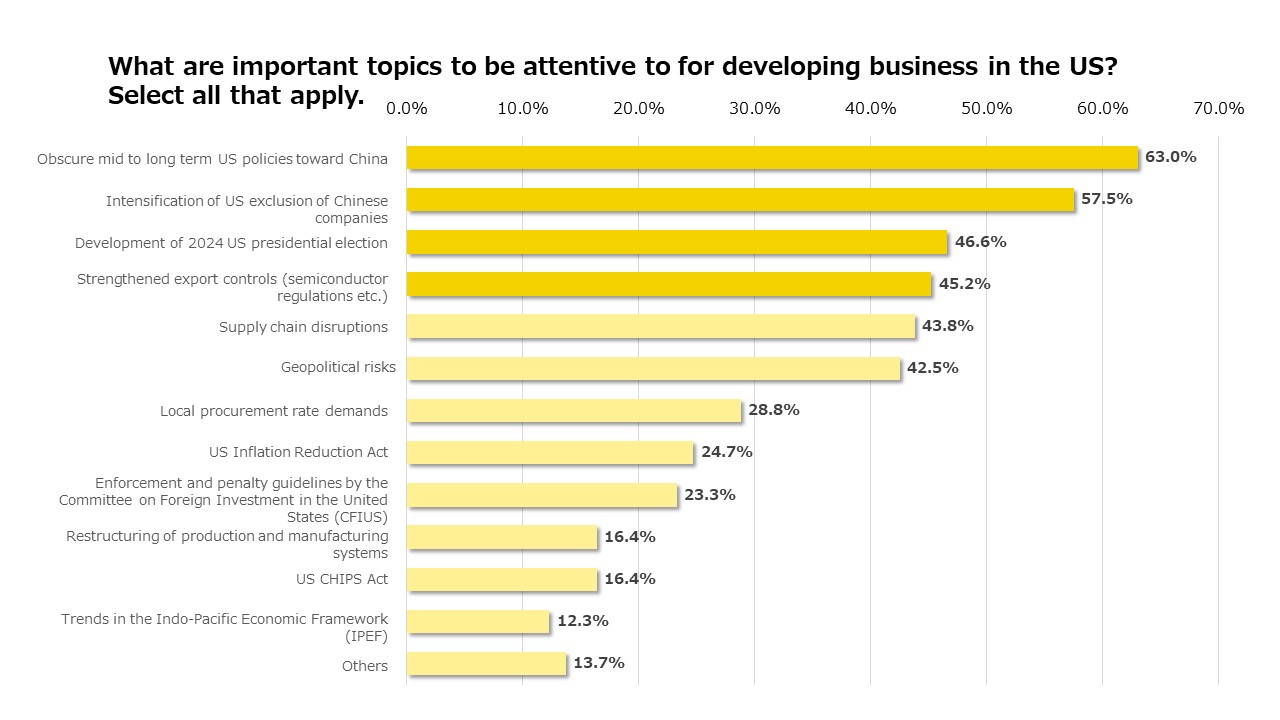

Like the 2022 survey, in the select-all-that-apply question, the largest percentage of firms pointed to the difficulty in forecasting Washington’s medium- to long-term China policy (up from 60% to 63%), followed by those paying attention to the escalation in the U.S.’ exclusion of Chinese firms (up from 54.3% to 57.5%). It is worth noting that 45.2% of the respondents selected “the U.S.’ strengthening of export control and restrictions on semiconductor trade in October 2022” — an option that was newly added into this survey. The ratio of this choice surpassed “supply chain disruptions” (down from 45.7% to 43.8%) and “geopolitical risks” (up from 38.6% to 42.5%), the two choices that were selected by the third- and fourth- largest groups of respondents in 2022.

Many more respondents were concerned about restrictions on semiconductors than the other regulations. Despite the fact that the U.S. came second after Japan as a preferred destination for boosting supply chain resilience, with the U.S. chosen by 58.1% of respondents, one in four firms said they are concerned with the IRA, CHIPS and CFIUS in doing business there. While Japanese firms are pushing ahead with friend-shoring — deepening economic ties with like-minded countries — their concerns about Washington’s tightening restrictions are on the rise.

Research and development

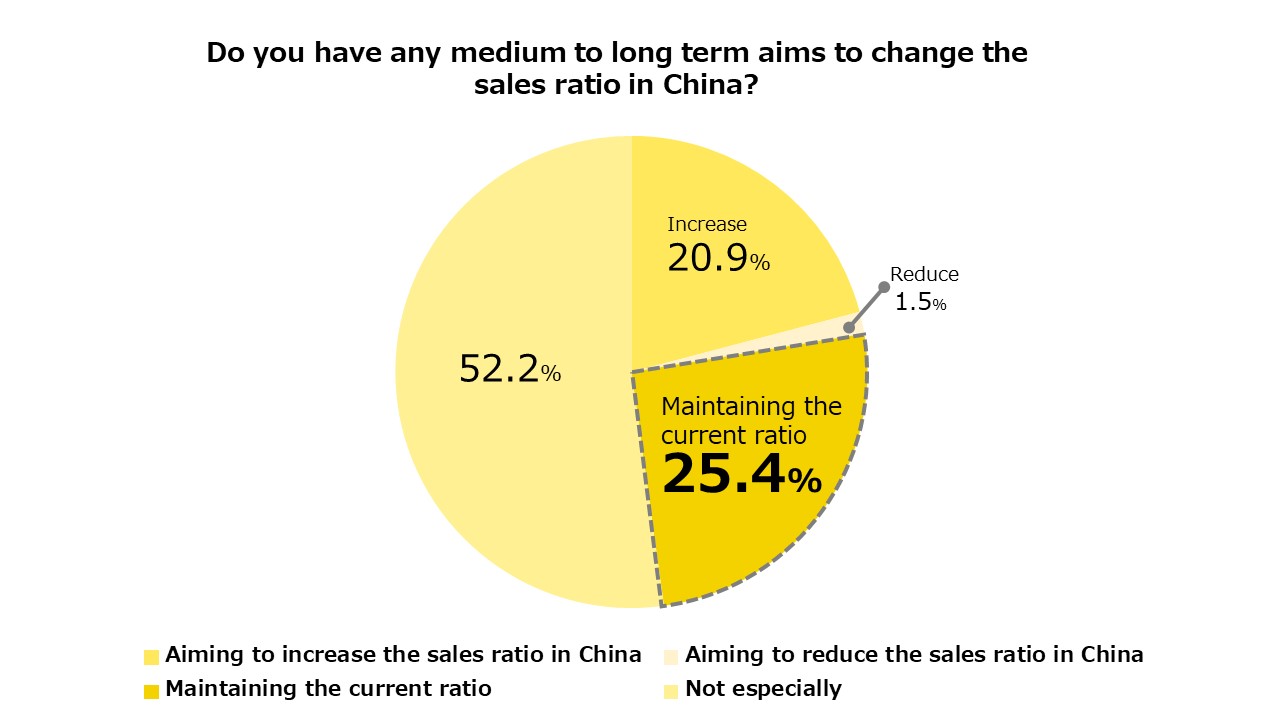

As Washington tightens regulations against China, Beijing is also implementing restrictions against Western countries, moving Japanese firms into a new phase of doing business in China. The percentage of Japanese firms with a medium- to long-term goal of increasing their sales in the Chinese market dropped from 25.8% to 20.9%, but the percentage of firms aiming to reduce their ratio of overseas sales in China declined from 4.5% to 1.5%, and those with a goal of maintaining the status quo rose from 13.6% to 25.4%. However, the results do not mean that Japanese firms are simply taking a wait-and-see attitude in the Chinese market.

Asked to choose the most-important issue in maintaining a competitive edge over Chinese companies, the largest percentage of respondents, 46.5% in 2023 — up from 42% in 2022 — said they are focusing on strengthening research and development. In the 2022 survey, strengthening management of intellectual property rights and patents was cited by the largest percentage of firms — 44.9% — but dropped to second place with 38% in 2023. While about a quarter of respondents said they aimed to maintain their current sales goals in China, it became clear that many are stepping up research and development to stay competitive in the country. Measures to prevent technology plagiarism remain important, but what became more important this year was strengthening offensive measures in order to beat the competition. Local production for local consumption is expanding in China as a way to avoid chokepoints in the global supply chain.

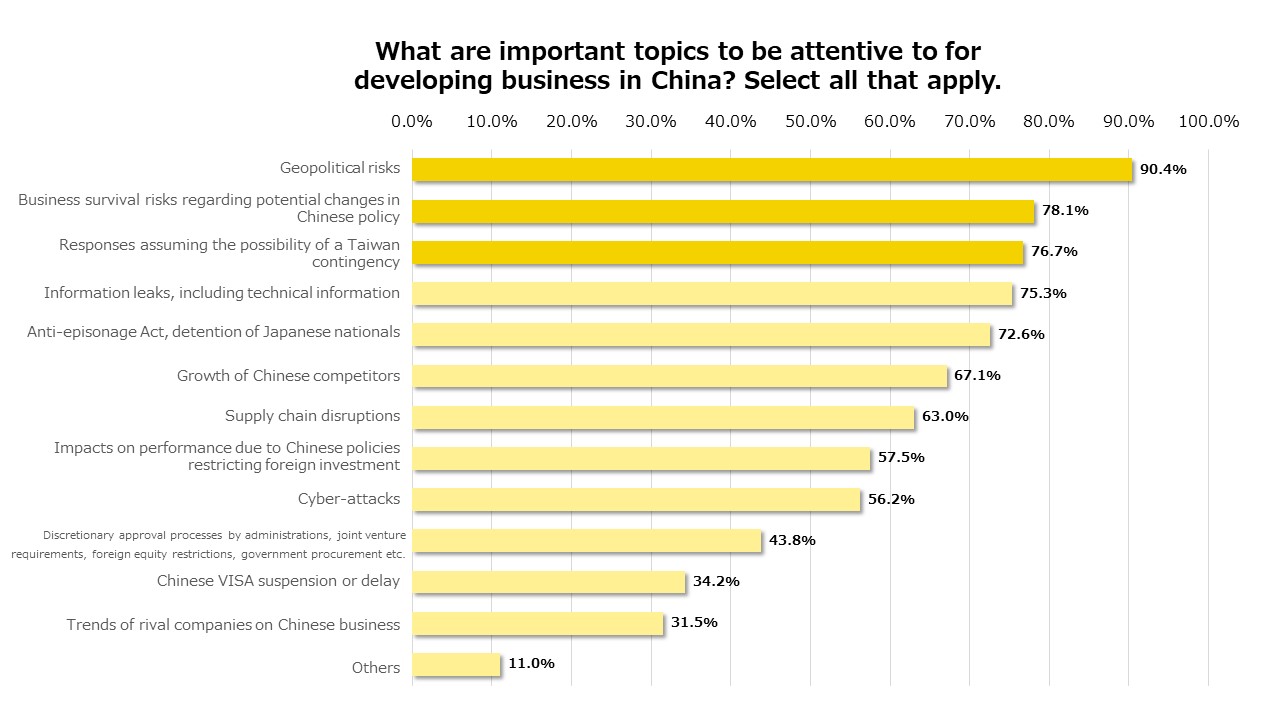

Apparently reflecting such a trend of intensified competition, the percentage of firms that said they pay attention to the growth of their Chinese rivals rose from 61.6% to 67.1%. U.S. President Joe Biden used to call on like-minded countries to decouple from China, and the European Union counter-proposed a de-risking strategy, but for Japanese firms, the Chinese market is changing into a place in which to compete for technological superiority. Apart from the new dimension of research and development, the top three issues cited by Japanese firms in doing business in China remained unchanged from 2022, with the percentage maintained or slightly increasing for all three: geopolitical risks (up from 84.9% to 90.4%); risks of business continuation due to changes in Beijing’s policies (unchanged from 78.1%); and preparations for a possible Taiwan contingency (up from 72.6% to 76.7%). Concerns related to de-risking have remained unchanged.

Taiwan and Ukraine

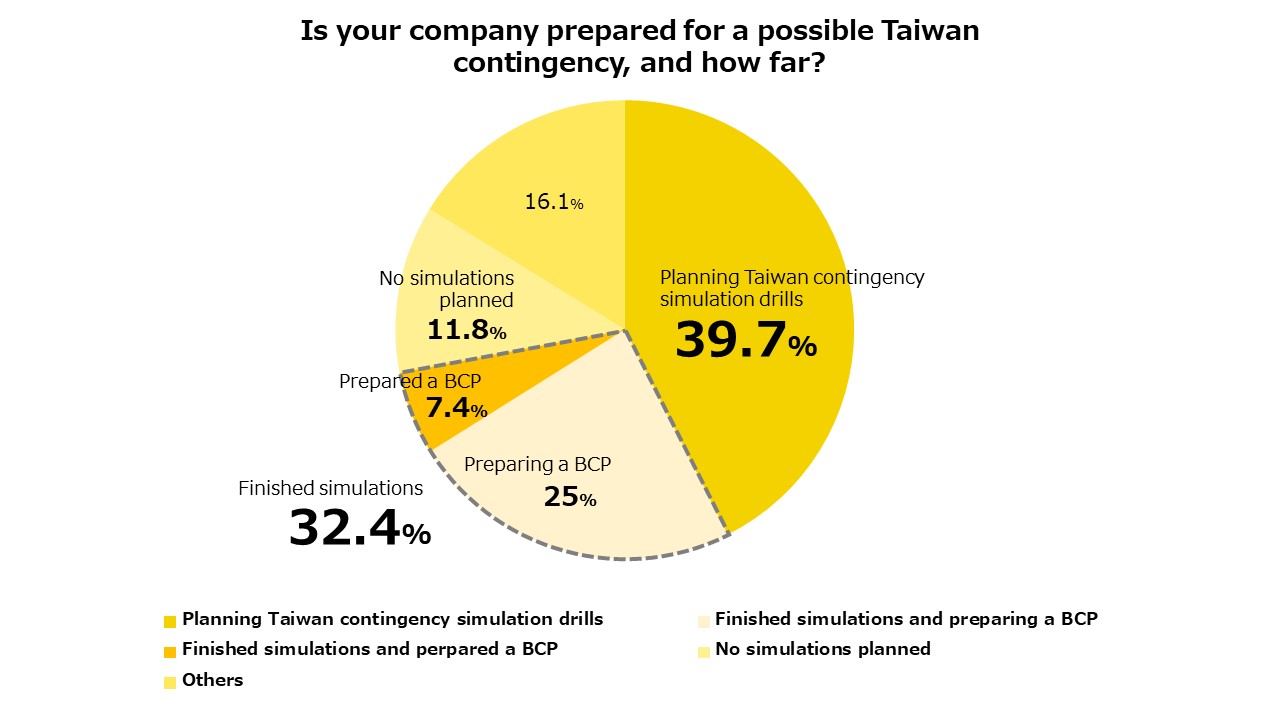

In the latest survey, Japanese firms were newly asked about their preparations regarding a possible Taiwan contingency, particularly whether they conducted simulation drills and prepared their business continuity plan (BCP).

Among the respondents, 32.4% said they have carried out simulations and are preparing, or have prepared, a BCP; 5.9% have already prepared one. On the other hand, 39.7% are currently preparing a simulation drill and 11.8% said they have no such plans. The results show that less than half of Japanese firms are still halfway through in their preparations. Meanwhile, the situation in Ukraine — a wake-up call that prompted Japanese firms to become aware of a possible Taiwan contingency — is having an extended impact on businesses.

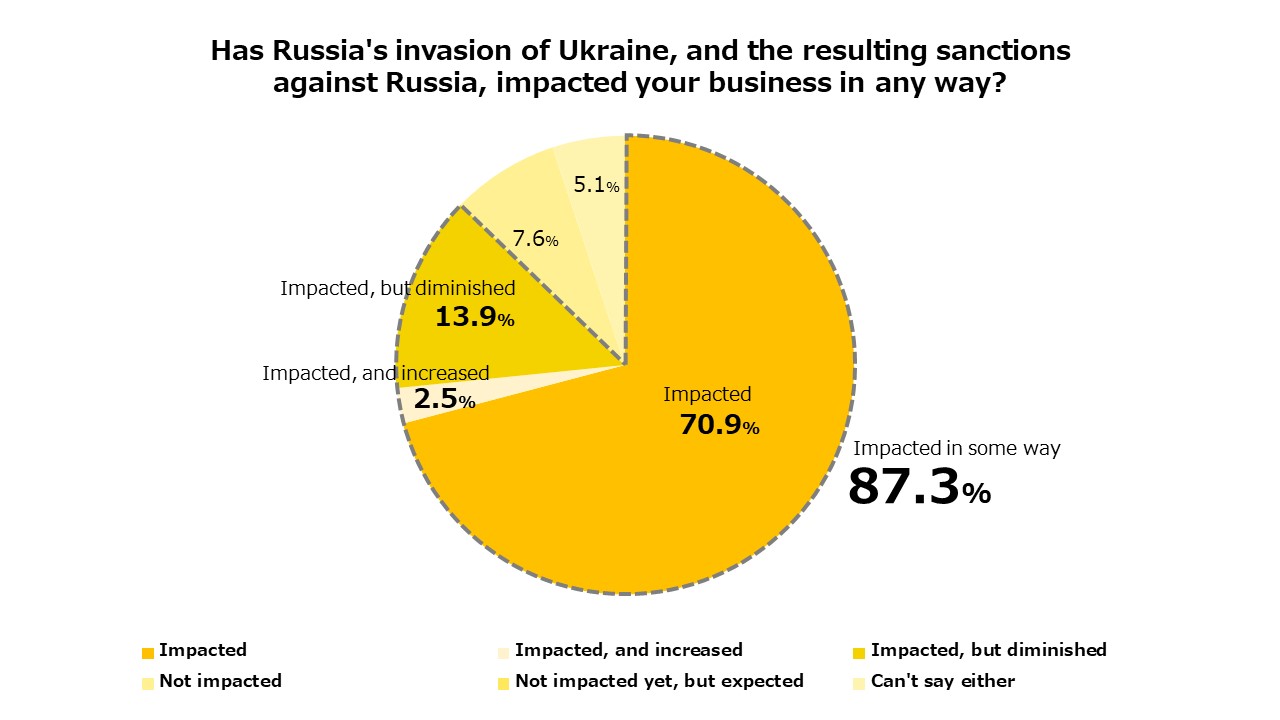

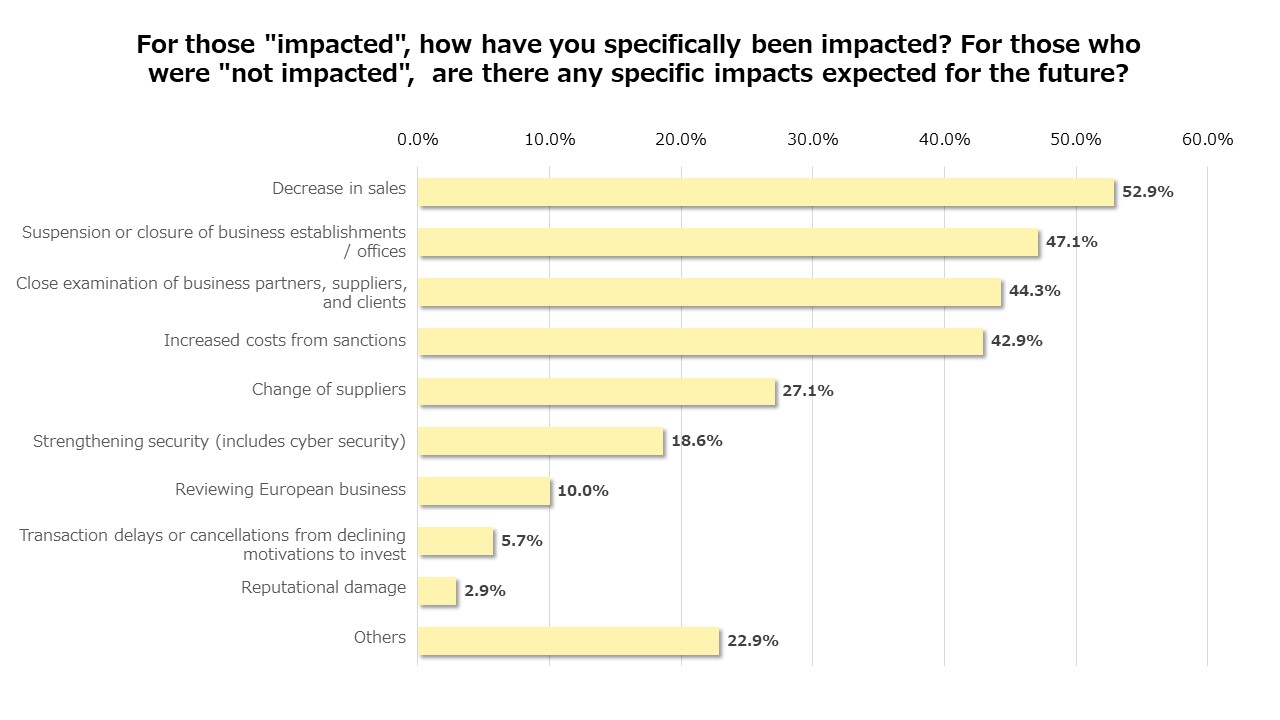

As many as 70.9% of respondents said they are affected by Russia’s invasion of Ukraine and sanctions against Russia, followed by 13.9% that said they had been affected at first but that the impact is receding. A total of 87.3% said their business are affected by the invasion, up from 83.8% in the 2022 survey. 2.5% said the impact has worsened. Asked what initiatives they think Japan should strengthen in advancing its economic security strategy, 14.1% of the firms said they expect the government to better address energy issues, up from 13.9%. It is clear that the firms are impacted by rising costs due to the sanctions on Russia.

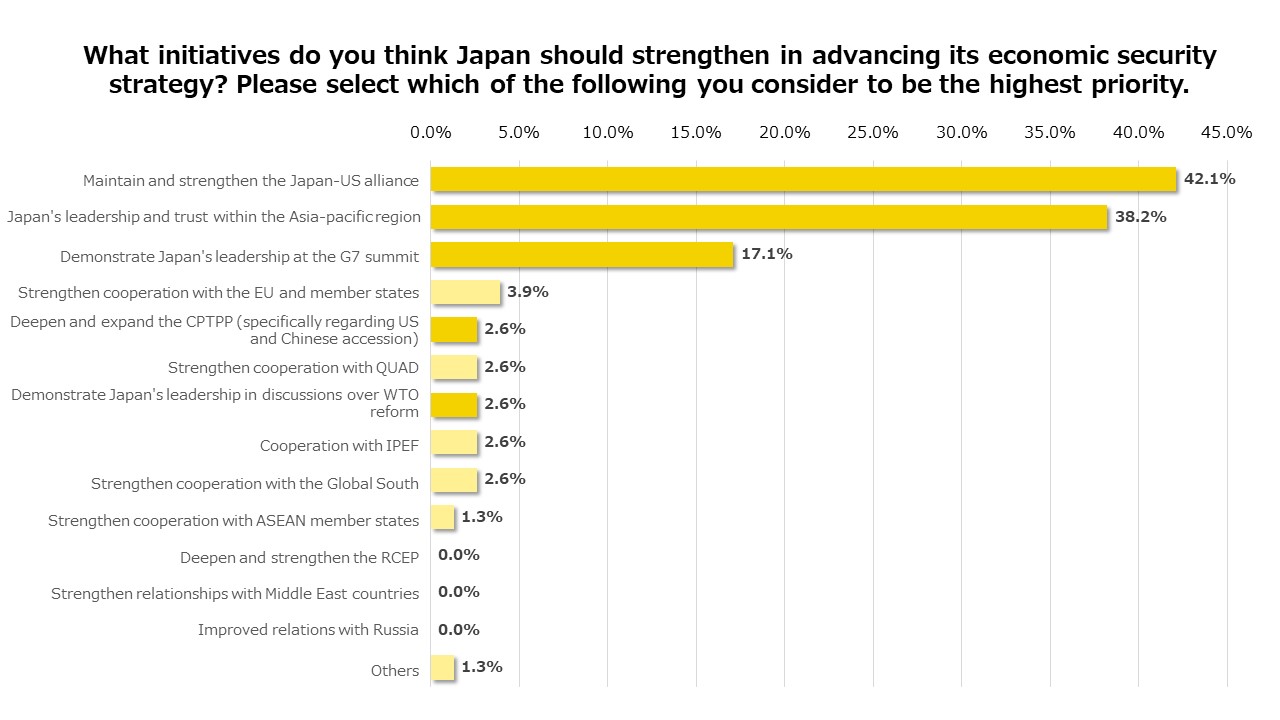

Expectations for a stable administration

Up from 35.9% in 2022 to 42.1% in 2023, Japanese firms ranked the Japan-U.S. alliance top for the first time since 2021 when asked which countries and regions Japan should strengthen ties with to proceed with its economic security strategy. The most preferred choice in 2021 and 2022 were Japan’s leadership in the Asia-Pacific region, at 37.2% in 2022 and only slightly higher at 38.2% in the 2023 survey. The results indicate that Japanese firms are focusing more on bilateral Japan-U.S. relations than on the multilateral relations with Asian countries amid growing uncertainty in the U.S.-China relationship.

The third-largest percentage, 17.1%, called for Japan to take a leadership role in Group of Seven summits, up from 16.7% in 2022, while the percentages declined for those asking for Japan’s leadership in reforming the World Trade Organization (WTO), down from 3.8% to 2.6%, and an expansion of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, down from 5.1% to 2.6%. With the November U.S. presidential election approaching, Japanese firms are refocusing on and “re-shoring” to bilateral Japan-U.S. relations.

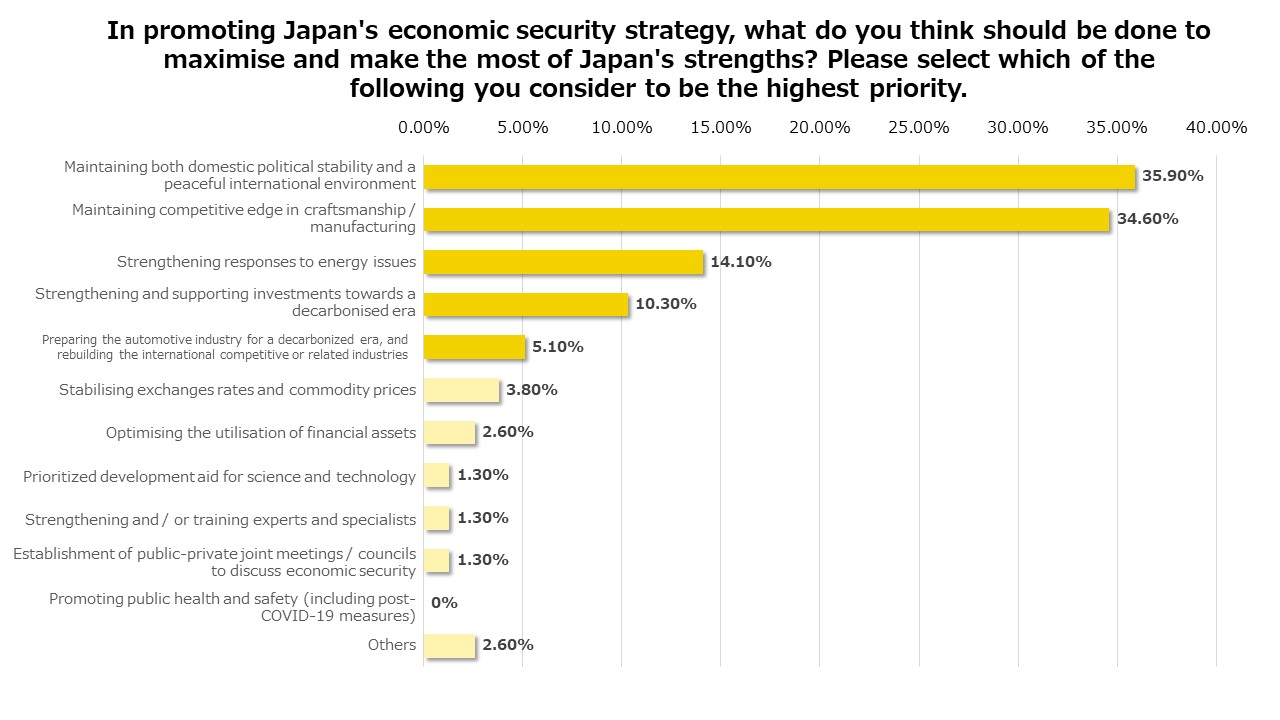

Asked what should be done to maximize and make the most of Japan’s strengths in promoting its economic security strategy, the largest percentage of respondents said the government should work on maintaining political stability at home and a peaceful environment abroad, up from 32.9% to 35.9%. In the 2022 survey, the largest percentage was to maintain competitiveness in manufacturing, but this dropped from 38% to 34.6% in 2023 and fell to second place. The third-largest majority of firms said the government must strengthen response to energy issues, up from 13.9% to 14.1%, as the conflicts in Ukraine and the Middle East increased the firms’ cost burden. The fourth-largest ratio called on the government to strengthen and support investments in decarbonization, increasing largely from 2.5% to 10.3%.

It is noteworthy that a larger percentage of firms focused on decarbonization as a whole rather than those coupled with manufacturing and automotive industry’s competitiveness. Manufacturing including automotive industry maintained a 5.1% share but fell to fifth place. The U.S. and China are both tightening their restrictions against each other amid intensifying economic confrontations, increasing uncertainty over the business environment for Japanese companies. The conflict between Israel and Palestine, in addition to Russia’s prolonged invasion of Ukraine, is making prospects worse.

This 2023 survey revealed Japanese companies’ stronger desire for domestic political stability and diplomatic action to maintain a peaceful international environment to achieve economic security, with nearly half of them focusing particularly on strengthening Japan-U.S. ties. During times of growing uncertainty, companies are seeking stronger bilateral ties with the U.S., rather than, but not excluding, focusing on multilateral relationships such as the Asia-Pacific frameworks and the WTO. However, this does not mean that Japanese firms have regained certainty about their business in the U.S. market, as they have stronger concerns about the outcome of the coming U.S. presidential election. The full results and analysis of this survey are scheduled to be published in English during the spring of this year.

[Note] This article was posted to the Japan Times on February 1, 2024:

https://www.japantimes.co.jp/commentary/2024/02/01/japan/japan-us-alliance-politics/

Author

Hitoshi Suzuki

Visiting Senior Research Fellow

COO, LLC future mobiliTy research

Japan-EU relations / Trade policy / Car & aeronautical industries / Supply chain and due diligence / Carbon neutrality

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It will also provide analyses of the state of the world and trade risks as well as technological and industrial structures. (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo)

Latest Contents

- 2024/04/23Starlink highlights economic security challenges facing democracies by Kota Umeda

- 2024/04/21How to deal with influence operations in the era of generative AI by Makoto Shiono

- 2024/04/16Can we trust the polls? How emerging technologies affect democracy by Kousuke Saito

- 2024/04/09How to stop the dominoes of war from falling in East Asia by Sadamasa Oue

- 2024/04/07Ukraine war has brought new challenges for international security by Goro Matsumura

We’ll keep up to date on latest briefings, videos, events, research activities, media coverage, and more.

APIニュースレター 登録

APIニュースレター 登録