How will Japan respond to new U.S. investment rules?

In addition, U.S. President Joe Biden signed an executive order last August to establish new outbound investment regulations under the so-called “small yard, high fence” concept. This means that strict regulatory measures will only be taken in sectors that could potentially threaten national security.

The U.S. Treasury Department is leading the formulation of these draft regulations while it seeks to generate public comments, mainly from the private sector. Against this backdrop, Japanese businesses — especially those that could be impacted by the proposed changes — need to make their voices heard before the new rules are finalized.

U.S. inbound investments

Since 1975, CFIUS — an interagency body chaired by the Treasury Secretary — has been reviewing inbound investments that could pose a threat to American security. Between 2015 and 2016, a surge of Chinese investment in the U.S. and the growing importance of dual-use technologies led policymakers to rethink and update CFIUS regulations — in part to address the increasingly held view of China as a strategic competitor. Congress passed the Foreign Investment Risk Review Modernization Act (FIRRMA) in 2018, which was signed into law by then-President Donald Trump.

In early 2020, the Treasury Department implemented the final regulations designed to strengthen CFIUS, which put certain transactions — such as acquisitions of American companies — under tighter scrutiny in the areas of critical technologies, critical infrastructure and sensitive personal data, among others.

The Biden administration picked up where the Trump administration left off and in September 2022, the incumbent signed an executive order indicating the areas that the CFIUS review process would consider “critical.” This included technologies such as microelectronics, artificial intelligence, biotechnology and biomanufacturing, quantum computing and advanced clean energy. Some members of Congress have also called on Biden to block Japan’s Nippon Steel from acquiring U.S. Steel under the updated CFIUS screening mechanism.

In view of U.S. presidential elections in November, the proposed takeover has become a campaign issue. Although both Trump and Biden have politicized it and come out against the deal, CFIUS’ decision on whether to approve the acquisition should be made consistently with the small yard, high fence concept, purely from a national security perspective. In other words, the issues of national security threats and domestic employment should be treated as distinct.

Outbound investment rules

Last August, Biden signed the aforementioned executive order on outbound investment, targeting China. The order focuses on three critical technology areas: semiconductors and microelectronics, quantum information technologies and artificial intelligence. It requires transactions in these areas to be notified and prohibits those involving serious threats.

As a senior Biden official explained to journalists, “The thing we’re trying to prevent is not money going into China overall, because they have plenty of money. The thing they don’t have is the know-how.” The official also signaled the government’s intention to prevent the outflow of advanced technologies not covered by conventional export controls — again, as part of the small yard, high fence approach.

A February 2023 report sheds some light on the background to these restrictions. It states that American venture capital firms, such as those owned by major American semiconductor companies, have provided various forms of support to China’s AI industry, in addition to investment. The report, “U.S. Outbound Investment into Chinese AI Companies” by Georgetown University’s Center for Security and Emerging Technology, provides an example of a company receiving American venture capital investment and subsequently being placed on the Department of Commerce’s list of companies banned from exporting, known as the Entity List.

The new regulations are expected to impose a comprehensive web of restrictions in these and other related cases. Following Biden’s executive order, the Treasury Department published what is known as an “advance notice of proposed rulemaking” and requested public comments in response to 83 questions.

The department indicated that it intends to prohibit transactions involving specific technologies in the three critical areas and to subject others to notification requirements. For example, under semiconductors and microelectronics, the Treasury Department is considering prohibiting transactions involving advanced integrated circuits and supercomputers under certain conditions. It is also contemplating a notification requirement for the “design, fabrication, and packaging of other integrated circuits” — a system that is also designed to help the U.S. government better understand the nature of investment practices and inform future policy.

In response, 61 submissions were made by industry associations and other interested parties mainly in the U.S. (none came from Japan). They provided specific comments about investments and technology and many also requested that the Treasury Department limit restrictions so that existing businesses would not be affected. The U.S. Chamber of Commerce and the Semiconductor Industry Association, for example, stated that the scope of the regulations should be clarified and narrowed down and that international coordination is needed to ensure that the rules do not affect only American firms.

It is taking the Treasury Department some time to analyze all the comments and then draft its regulations — a reminder that formulating outbound investment controls is no simple task. Meanwhile, the National Critical Capabilities Defense Act was introduced in the U.S. House of Representatives in May 2022. The scope of its restrictions was broader than Biden’s executive order, however, the bill did not pass due to disagreements over its scope and methodology.

Therefore, the Treasury Department’s draft regulations may well influence future discussions in Congress — and in like-minded countries, including Japan.

Japanese regulations

In November 2019, Japan strengthened its inbound investment regulations by amending the Foreign Exchange and Foreign Trade Act. The threshold for transactions requiring prior notification had previously been foreign investments of 10% or more, but the new rules lowered this to 1% or more. In addition, the notification system was expanded to include cases such as proposals for appointing directors and details of business transfers in certain sectors.

However, exemptions under specific conditions were also established, including when foreign investors are not involved in management and do not have access to undisclosed technical information. Foreign companies are required to determine whether they meet the exemption criteria at the time of the business transaction and, if so, whether it would be sufficient to file a later report.

The government has thus significantly expanded the scope of regulations while establishing a wide range of exemption criteria. Its task now is to monitor compliance. Japan aims to increase its balance of incoming foreign direct investment from ¥46.2 trillion, as recorded at the end of 2022, to ¥100 trillion by 2030. Therefore, it needs to ensure that enough specialist personnel are available to monitor whether foreign investors using the exemption system are indeed not involved in management or privy to private technical information.

On the other hand, unlike in the U.S., an open, public discussion about Japan’s outbound investment regulations is not taking place. This is despite the Group of Seven leaders’ statement on economic resilience and economic security made at last year’s summit in Hiroshima, which specifies that “appropriate measures designed to address risks from outbound investment could be important.”

Outside of Japan, the European Commission adopted new initiatives in January to strengthen its economic security. Among them, the commission intends to “identify potential risks stemming from outbound investments in a narrow set of technologies.” However, the EU executive also expressed caution, citing a lack of data to proceed with the initiative. For this reason, after a process of public consultation, the commission will recommend that member states undertake one year of monitoring and its assessment is scheduled for next fall.

Given the complexity and economic impact of outbound investment regulations, it is necessary for G7 countries to gather more data and hold further discussions. It is also important for the Japanese government to first gain a better understanding of outbound investment flows by dialoguing with and collecting data from the private sector.

On this basis, in addition to discussing outbound investment regulations for Japan, it is also important for Japan to express its opinions on the proposed U.S. regulations soon to be released by the Treasury Department. It goes without saying that once these rules have been decided, it will be too late for Japan to make its views known. The impact on Japanese companies, including Japanese-owned American firms, will be significant, and they need to start preparing now.

[Note] This article was posted to the Japan Times on May 27, 2024:

https://www.japantimes.co.jp/commentary/2024/05/27/japan/us-new-investment-regulations/

Geoeconomic Briefing

Geoeconomic Briefing is a series featuring researchers at the IOG focused on Japan’s challenges in that field. It also provides analyses of the state of the world and trade risks, as well as technological and industrial structures (Editor-in-chief: Dr. Kazuto Suzuki, Director, Institute of Geoeconomics (IOG); Professor, The University of Tokyo).

Disclaimer: The opinions expressed in Geoeconomic Briefing do not necessarily reflect those of the International House of Japan, Asia Pacific Initiative (API), the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

Photo Credit: Aflo

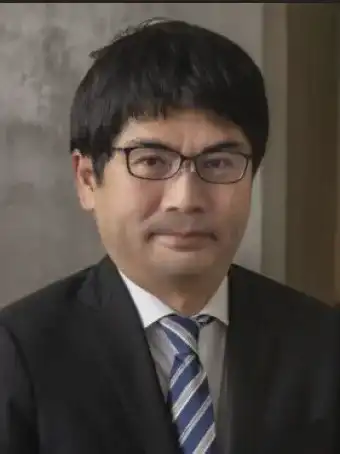

Visiting Senior Research Fellow

Satoshi Yamada has been a visiting senior research fellow at the Institute of Geoeconomics (IOG) since 2022. He has over 25 years’ experience in the Japanese private sector. From 2018 to 2022, Mr. Yamada was stationed in Washington, D.C., where he worked to establish a government relations and public policy team. During that time, he also worked with U.S. industry associations and think tanks engaging the U.S. government (both the Trump and Biden administrations) and the Congress. Prior to 2018, he worked on various social infrastructure projects in emerging economy countries, collaborating with multilateral development banks and development aid agencies. He holds an MBA from the Sloan School of Management at the Massachusetts Institute of Technology, and also studied at The Fletcher School of Law and Diplomacy at Tufts University.

View Profile