IOG Economic Intelligence Report (Vol. 3 No. 5)

The latest regulatory developments on economic security & geoeconomics

WTO Summit Concludes: The WTO summit concluded on March 2 without having reached any major agreements beyond an agreement to extend themoratorium on e-commerce duties for another two years until the next WTO meeting. The summit failed to reach agreementson fishing, agricultural, dispute settlement, and other issues. Additionally, Comoros and Timor-Leste were formallyadmitted to the organization, bringing its membership to 166 economies.

Nippon Steel Begins Formal Negotiations with Steelworkers’ Union: The United Steelworkers Union (USW) has signed a non-disclosure agreement (NDA) with Nippon Steel, allowing the twoparties to begin negotiations amidst Nippon Steel’s proposed acquisition of U.S. Steel. Because of USW membership isconcentrated in Ohio and Pennsylvania, two states that will be critical for deciding the U.S. presidential election inNovember, the union’s acquiescence to U.S. Steel’s purchase is critical for the agreement’s political viability.According to observers, both the USW and Nippon Steel would like to conclude an agreement before the November elections.The negotiations are expected to focus on the future of U.S. Steel’s blast furnaces (where union jobs are concentrated)and guarantees on Nippon Steel’s management promises, particularly on the possibility of layoffs.

U.S. Hits Russia with New Sanctions Following Navalny’s Death: U.S. President Biden announced more than 500 new sanctions on Russia following the death of opposition leader AlexanderNavalny in an Arctic penal colony on February 16. The new sanctions are aimed at three individuals associated with thepenal colony where Navalny was imprisoned (the prison warden, the regional prison head, and the deputy director ofRussia’s federal prison system) and will also target Russia’s defense sector, financial sector, and procurementnetworks, along with additional price cap sanctions.

Concern EU Isn’t Doing Enough to Keep Tech Out of Russia: European Union officials are concerned that member states are not doing enough to prevent Russia from acquiringsanctioned technologies that could help it in its invasion of Ukraine. Sanctioned products are believed to enter Russiavia trade with third countries, specifically Turkey, the United Arab Emirates, Serbia, and China, as well as others.While official direct trade between the EU and Russia collapsed following the imposition of sanctions, exports of goodsfrom third countries surged and helped fill the gap. EU officials told Bloomberg that companies in the EU are doing toolittle to stop this trade, either knowingly or unknowingly.

New U.S. Restrictions on Bulk Personal Data: The Biden administration issued an executive order on February 28 that restricts “countries of concern” from accessingbulk sensitive personal data of Americans, including “genomic data, biometric data, personal health data, geolocationdata, financial data, and certain kinds of personally identifiable information”. The executive order follows a reportfrom the Office of the Director of National Intelligence that such large scale transfers occur with “alarmingregularity”. Key terms, including “bulk” and “countries of concern remain undefined, as well as how the order will bespecifically implemented.

New Steps to Shield Solar Supply Chains from Forced Labor: U.S. Customs and Border Protection sent a questionnaire to solar companies in the United States amidst an effort to seekgreater information about products made with forced labor in the solar supply chain. The questionnaire requestsdisclosure about the source of modules, panels, and other products, while before importers only needed to provide suchinformation if shipments were detained for inspection. The effort follows a June 2022 ban on the import of goods fromChina’s Xinjiang region, where there have been allegations of forced labor (and more) against the region’s Uyghurcommunity.

Analysis: ASEAN in the Geoeconomic Context

For all the discussion about the rise of China over the past thirty years as its economy has grown to be the world’s second-largest, attention should also be turned to the growth of the Association of Southeast Asian Nations (ASEAN), a group who are expected to become the world’s fourth largest economy by the end of the decade. The emergence of the ASEAN states is as impressive as China’s reemergence – in many ways, China hasn’t grown so much as recovered its health after almost a century of wars, occupation, and catastrophic mismanagement. On the other hand, most of the ASEAN economies are taking a share of global GDP that they never have before in their history while also overcoming similarly violent histories. Any narrative of the ASEAN economies will be oversimplified because their economic and political diversity, but it’s fair to begin recognizing these economies as a geoeconomic force in their own right, rather than a staging ground for China-U.S. geopolitical competition.

At the same time, it’s difficult not to think about ASEAN beyond geopolitical competition because ASEAN, like Japan and others, is stuck in the of it. While some, like Japan, will lean towards the United States for security reasons, all countries in the region will want to balance between optimizing the economic opportunities that China and the United States present while also securing themselves against military and economic coercion from China.

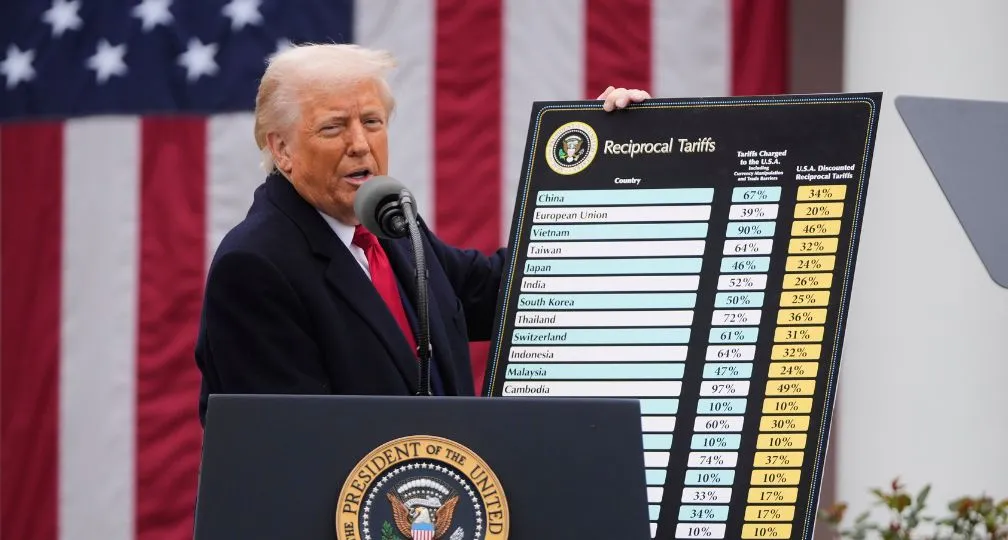

This isn’t necessarily disadvantageous; in fact, ASEAN may be the biggest beneficiary of “decoupling”. Adding tariffs, like Donald Trump did when he added tariffs on China, will always impose extra costs on doing business, but a big reason, maybe the biggest reason decoupling is happening is because the relative advantage of China’s market isn’t what it used to be for a lot of sectors, and the relative disadvantages of ASEAN’s markets aren’t what they used to be. ASEAN is simply a more capable region than it used to be, and the trade and investment numbers and the position along supply chains reflects this. ASEAN was indirectly featured in last August’s Camp David Principles between Japan, South Korea, and the United States, highlighting its role as a broader regional player beyond only Southeast Asia and the western Indian Ocean. Decoupling isn’t only about China; it’s about ASEAN economies as well.

What’s important for global governance cynics to understand is that for all of the talk about the decline of the liberal international order, particularly among “Global South” states, ASEAN is a region that wants an international order that’s liberal and rules-based. The region is a strong example of how prosperity follows from rules-based exchange, and they’ve internalized the process well. They may not necessarily have a need for that order to be U.S.-led, and probably don’t have a sentimental desire for U.S. leadership, but for they still want and expect the United States, along with others, to provide the public goods that enable a rules-based order and are mostly skeptical that China can provide those goods instead.

For now, Japan has entered the gap of a country that can help buttress a rules-based order and it’s done so fairly effectively. The question is how long Japan can do this and to what extent because its economic heft is limited relative to the two powers that are facing off. The bigger reality is that China’s position is still ambiguous and contradictory, if not hostile given its posture towards the South China Sea, while the United States is apparently ambivalent about leadership in this space and is really beginning to lack to domestic political capacity to provide global goods. Both sides in the competition will need to tread carefully – ASEAN states will prioritize the ability to maintain their freedom to maneuver, and U.S. demands on ASEAN economies vis-à-vis China may ultimately be counterproductive. The most constructive thing that the United States could do would be to continue to build a regional economic architecture in cooperation with countries like Japan and Australia. This would not only continue to build a more resilient framework for prosperity but also help the region respond to potential economic coercion.

For now, ASEAN has adjusted well to the situation and should continue to do so. At the same time, it may not always be able to count on a global order that’s as accommodating to ASEAN’s interests. Further institutionalization that builds off of CPTPP, RCEP, and even IPEF, along with a focus on resiliency and economic security would further help ASEAN economies account for geopolitical competition.

Disclaimer: The views expressed in this IOG Economic Intelligence Report do not necessarily reflect those of the API, the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

API/IOG English Newsletter

Edited by Paul Nadeau, the newsletter will monthly keep up to date on geoeconomic agenda, IOG Intelligencce report, geoeconomics briefings, IOG geoeconomic insights, new publications, events, research activities, media coverage, and more.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 The Lessons of the Nippon Steel Saga2025.07.08

The Lessons of the Nippon Steel Saga2025.07.08 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27