IOG Economic Intelligence Report (Vol. 2 No. 20)

The latest regulatory developments on economic security & geoeconomics

EU-U.S. Tariff Talks Collapse: High-level talks between the European Union and United States to resolve their trade disputes on steel & aluminum and critical minerals took place on Friday, October 20 without a breakthrough. U.S. President Joe Biden hosted European Commission President Ursula von der Leyen and European Council President Charles Michel in Washington for a summit that had initially aimed to achieve a meaningful deal but this was reportedly walked back to an agreement to “make progress” on the disputes. In the absence of a deal on a Global Arrangement on Sustainable Steel and Aluminum (GSA), U.S. tariffs and EU counter-tariffs are set to be put back into place on January 1. According the EU, the key reason an agreement was not reached was because the United States refused to clarify when it would remove punitive Section 232 tariffs against the EU.

International Cooperation on AI: 28 governments, including the EU and China, issued the Bletchley Declaration on November 1, expressing the concern that artificial intelligence poses a potentially catastrophic risk to humanity, the first global declaration addressing the emerging technology. The signatory countries agreed to work together on developing regulations, research into safety, and more. South Korea has agreed to host a further summit on the issue in six months, while France will host the same in a year. The declaration builds on efforts made at the UN Internet Governance Forum held in Kyoto in October.

Additionally, on October 31, the Biden administration signed an executive order to govern AI technologies. The order relies on the Defense Production Act of 1950 to require AI developers to share safety test results and similar information with the government, in addition to requirements to watermark AI images as well as addressing questions of privacy, civil rights, consumer protections, and more. The order will need to be augmented by congressional action to become binding, and Congress is currently in the process of considering a set of AI regulations.

Combating Seafood Coercion: G7 states called for the immediate repeal of import curbs on Japanese seafood following Japan’s release of treated wastewater from the Fukushima nuclear plant. While China was not named specifically in the statement released following a working group meeting of G7 trade ministers in Osaka, Japan, China imposed a blanket import ban on all seafood imports from Japan in August in reaction to the wastewater release.

Relatedly, the U.S. military has begun buying bulk purchases of Japanese seafood to offset China’s ban. U.S. Ambassador to Japan Rahm Emmanuel commented on the move, saying that “The best way we have proven in all the instances to kind of wear out China’s economic coercion is come to the aid and assistance of the targeted country or industry” and said that the United States should look more broadly into how it can offset the impact of China’s “economic wars”.

New Financial Measures Targeting Hamas: The U.S. Treasury Department announced new rules to prevent actors from assisting Hamas in evading sanctions following its October 7 attack southern Israel. U.S. Treasury Secretary Janet Yellen said that the United States is looking into further efforts to financially punish Hamas and that she would work with counterparts in Europe and the Middle East to explore new ways to target the group. For its part, Japan announced that it would freeze the assets of nine individuals it accuses of fundraising for Hamas.

New Rules against China: Alan Estevez, Undersecretary of Commerce for Industry and Security, said in an interview with Nikkei Asia that the United States is considering restrictions on China’s access to cloud computing services. According to the interview, such potential controls would be in line with earlier U.S. efforts to restrict China’s access to advanced technologies on the grounds of preventing their use for military purposes.

Analysis: Stop Blaming Globalization for Economic Insecurity

The story is simple – after the collapse of the Soviet Union, the United States collected its peace dividend by expanding economic liberalization throughout the world in the belief that liberalization would entrench new democracies or even entice totalitarian regimes to abandon authoritarianism in favor of liberal democracy. As the argument goes, the globalists were so confident in their program that they believed that by expanding economic relations with former adversaries like Russia or quickly growing but totalitarian China, these countries would create the conditions necessary for democracy to take hold. And as the argument concludes, the fact that not only did either country fail to democratize, but even turned into two of the world’s most significant geopolitical challenges to the liberal international order demonstrates that the globalists ambitions were always idealistic and overambitious, and possibly unwittingly empowered a new global axis to challenge the United States.

It’s a simple story but it’s also not entirely correct. For one, both China and Russia (and others) eagerly sought the economic benefits of liberalization themselves, so globalists were pushing on an open door. When those countries failed to democratize as hoped, it had more to do with issues beyond the realm of economics. Relatedly, while plenty of members of Congress and administration officials made a lot of optimistic statements in the media about the possibilities of liberalization, the optimism of most decision makers was more circumscribed, being guardedly optimistic rather than jumping in with both feet and blindfolded. Finally, and most importantly, the story overlooks the factor that made economic liberalization the commonsense answer regardless of what any globalists might have believed: the role of technology.

It’s an oversimplification, but modern globalization was enabled by two key technologies: the shipping container and the internet. Containerization contributed by standardizing shipping containers to facilitate intermodal shipping, allowing more goods to be shipped more quickly and at lower cost than ever before in history. The internet contributed by reducing the cost of communication, enabling ideas to be shared more easily, promoting international collaborations, and expanding the potential for innovation and trade in services. Put together, these technologies contributed to forming the complex supply chains that facilitate global commerce.

Expanding globalization as a policy agenda after the end of the Cold War made logical and practical sense. The idea that free markets would underpin security wasn’t just a product of a post-Cold War Washington Consensus, but one of the foundational assumptions of U.S. international economic strategy after World War II. This itself was a reaction to the experience of the interwar period, when tariffs and other commercial barriers broke the world up into competing economic blocs that U.S. postwar planners believed contributed to the war. It made sense to dust off and revive the logic after the collapse of the Soviet Union, partly because the United States and its economic model had apparently triumphed, partly because it seemed to have successfully helped to contribute to peace and economic wealth in former adversaries Germany and Japan, and partly because technological advances simply made economic interdependence easier. There wasn’t a significant countervailing force, either intellectual or practical, pulling decision makers in any other direction.

At the same time, the fact that supply chains and globalization were fundamentally private sector strategies centered the role of firms in global economic architecture in ways they never were before, in a venue that before was almost exclusively the realm of governments. The result is a private sector that is more powerful but also essential for creating and maintaining some of the platforms necessary for future life. The trade-off is that markets and firms work by their own logic, usually profit, and there’s no guarantee that their logic will align with that of the state or with the national welfare. It might, but not necessarily.

The upside to all this is that globalization has enabled more products and more innovation to be traded more affordably than at any point in human history, expanding employment and improving welfare for billions as a result. The downside is that more connections and more nodes means there are more points where disruption can be felt, a lesson that the world learned the hard way during the COVID-19 pandemic, with Russia’s invasion of Ukraine, and through the various forms of economic coercion that can be exploited.

The mistake made by U.S. decision makers wasn’t to liberalize the global economy, but to shrink the government’s relationship with the private sector and retreat from oversight and regulation. Globalization expanded simultaneously with an ideological shift in favor of limited government, the primacy of the private sector, and the expansion of finance (itself a development enabled by improvements in communications technology that let larger financial sums more quickly and securely). Leaving aside the merits of the ideological shift, it’s left the United States government unprepared as it begins to rely on tools of economic statecraft more than ever. As Henry Farrell and Abraham Newman point out in the recent issue of Foreign Affairs, the U.S. government has little understanding of how supply chains work and few tools with which to learn or manage supply chains, even in regards to monitoring flows and transactions. Farrell and Newman correctly argue that the governments that have been more successful at addressing challenges to economic security are those, like Japan, that maintained a closer relationship between the private sector and the government.

The mistake wasn’t to overestimate the benefits of economic liberalization, it was the assumption that threats to economic security could be managed under a framework that preferenced the private sector. On one hand, it’s simply harder to subordinate markets to national security because the private sector is as much an actor in these spaces as national governments, often more so. On the other hand, it’s a lot harder to do when governments have taken themselves out of the picture. The influence of technology on globalization means that economic connectivity isn’t going to go away. Instead, trying to incentivize firms to prioritize public goods over profit maximization will be one of the key policy challenges for the next fifty years.

Disclaimer: The views expressed in this IOG Economic Intelligence Report do not necessarily reflect those of the API, the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

API/IOG English Newsletter

Edited by Paul Nadeau, the newsletter will monthly keep up to date on geoeconomic agenda, IOG Intelligencce report, geoeconomics briefings, IOG geoeconomic insights, new publications, events, research activities, media coverage, and more.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

View Profile-

A ‘Sputnik’ moment in the global AI race2025.07.03

A ‘Sputnik’ moment in the global AI race2025.07.03 -

China’s shipyard dominance leads to geoeconomic risks2025.07.02

China’s shipyard dominance leads to geoeconomic risks2025.07.02 -

Democracy shouldn’t be used as an ideological weapon2025.06.26

Democracy shouldn’t be used as an ideological weapon2025.06.26 -

From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 -

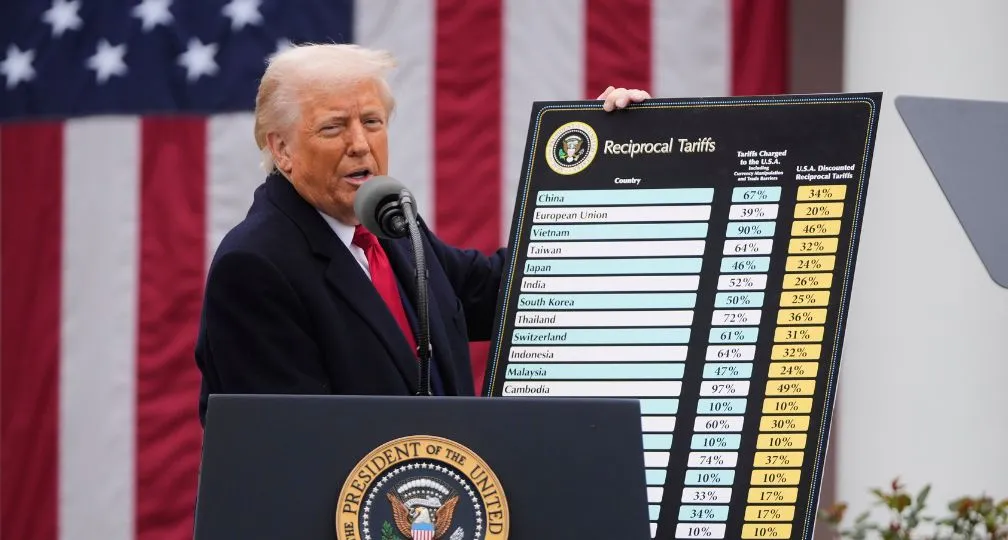

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27 After tariffs: Is there a plan to restructure the global economic system?2025.04.03

After tariffs: Is there a plan to restructure the global economic system?2025.04.03