IOG Economic Intelligence Report (Vol. 2 No. 3)

The latest regulatory developments on economic security & geoeconomics

The Dutch Are In: The Netherlands has reached an agreement with the United States to impose export restrictions on advanced microchip manufacturing technology into China, consistent with those imposed by the United States in October 2022. Dutch participation is expected to make U.S. controls on these technologies more effective given that the Netherlands are home to ASML, one of the world’s only manufacturers of a type of advanced production equipment used to produce high-end semiconductors.

Japan Adding Controls: The Kishida administration is expected to introduce semiconductor export controls in an attempt to prevent other states from using those technologies for military applications. The new regulations will specifically revise a ministerial ordinance that will cover equipment at the same standards set by the United States in its controls announced in October 2022.

There’s More?: Michael McCaul, chair of the House Foreign Affairs Committee, told Politico that the Biden administration is thinking about how to prevent outbound investment into entire sectors of China’s economy beyond semiconductors, including AI, 5G, quantum computing, and more, and would effectively prohibit any potential investor from working with Chinese companies that are active in these fields. If true, this would be a maximalist application of the Biden administration’s argument that restrictions would be carefully tailored, with restrictions being applied to entire sectors rather than to specific technologies. At the same time, the Commerce Department is reportedly trying to narrow the scope of proposed restrictions on outbound investment, suggesting that internal debates within the administration are ongoing.

More than Geopolitics: Ditlev Blicher, president of Asia-Pacific operations for Moller-Maersk, the world’s second-largest container shipping line, said that he expects supply chain volatility to be a more permanent condition rather than a reflection of the continuing effects of the pandemic. Rather than pointing to geopolitics, he argued that supply bottlenecks resulting from having thousands of producers along a supply chain will affect how shipping companies do business in a supply chain world. He argued that bottleneck pressures would be best relieved by improved logistics rather than shipping capacity.

EU & Mercosur: German Chancellor Olaf Scholz called for a quick resolution to negotiations on free trade talks between the European Union and the Mercosur economic block comprised of Argentina, Brazil, Paraguay, and Uruguay, more than twenty years after negotiations began.

APEP Assemble: The Biden administration announced that the membership of the Americas Partnership for Economic Prosperity (APEP) would include Barbados, Canada, Chile, Colombia, Costa Rica, the Dominican Republic, Ecuador, Mexico, Panama, Peru, and Uruguay. Like the Indo-Pacific Economic Framework (IPEF), which APEP appears to parallel, APEP will include five pillars on regional investment, supply chain resilience, economic security, clean energy, and inclusive trade.

Challenge Issued: The Biden administration formally challenged the World Trade Organization’s ruling against tariffs imposed during the Trump administration on steel and aluminum import for national security reasons.

Trade Talks with Kenya: The Biden administration will begin talks with Kenya on “high standard commitments” in a number of areas. Like similar discussions under the Biden administration, tariff discussions are not on the table.

Analysis: Globalization’s Not Over Yet

Any discussion of the future of globalization (and lately there have too many to count) can’t hold its own unless it accounts for the role of the private sector. The drive toward integration was because it made the most commercial sense, not because liberal internationalists in the United States decided to mash the “globalization” button on the control board. As important – maybe even more important – was the rapid drop in the once-prohibitive costs of transportation and communication which in turn meant that offshoring production and supply chains became the common sense of doing business. The shipping container brought the cost of transporting goods to almost zero, the internet reduced the costs of communication to the point where it was possible to offshore services, financial deregulation made it possible to finance offshore operations. The opportunities that all of this presented started a bandwagon that an increasing number of countries wanted to participate in and continually seek to benefit from. There are too many genies to put back into too many bottles to go back to pre-globalization or something like deglobalization.

But more than anything else what made globalization pervasive was that the system basically worked. The appeal of the rules-based order isn’t normative or because the idea of the WTO stirs anyone but because it’s still the best path to welfare – and the data on trade seems to confirm that governments and firms continue to believe this. As economist Richard Baldwin has shown, trade in goods might be declining but trade in services continues to grow. The fundamental assumptions and phenomena that led to the rules-based order still hold.

What’s changed is that the assumptions now come with more caveats, specifically over security. For governments, security means national security and concerns about being overdependent on potentially hostile states. To a point, it’s a natural reaction to legitimate problems like the various supply chain shocks and concerns about how China might leverage its supply chains for geopolitical gains. It might also be that a “security” framing is the only way to make a pitch in Washington – former secretary of Defense Ash Carter even once told Congress that ratification of the Trans-Pacific Partnership was as important as another aircraft carrier (maybe revealingly, the United States eschewed TPP but has planned for additional aircraft carriers).

For firms, thinking about security means resilient supply chains that can withstand disruptions from shocks like the covid-19 pandemic or similar crises. They are far less interested in geopolitical competition than China and the United States and would like to avoid picking sides as far as possible, while also recognizing that risks have changed or are becoming more acute.

Sometimes these different perceptions can work together to achieve a positive-sum outcome for states and firms, like with firms’ relocating some facilities to Southeast Asia – a Boston Consulting Group projected that Southeast Asian economies would see their trade grow by $1 trillion as a result of changing supply chain patterns. But that includes a projected $438 billion in trade with China, reiterating that this isn’t a question of choosing sides.

In other places, incongruences will lead to unintended consequences, like the potential that China might successfully develop and export its own advanced semiconductor manufacturing equipment and undercut both U.S. business and U.S. security goals. Or those warned of in a report by the Information Technology Industry Council (ITI), a trade association representing 80 global information and technology companies, that warned of potential consequences to innovation if economic controls impaired international collaboration. While administration officials often proclaim that the “era of efficiency” is over, there’s more to supply chains than efficiency, like access to innovation and the ability to access the firms and countries that provide the highest skills.

That in turn often hinges on the incentive of market access, because the best way to shape behavior in support of a trading system guided by rules is to leverage incentives to firms and states. Right now, the Biden administration’s trade policy seems to consist of polite suggestions and export controls but is missing any potential inducements that might leverage concessions on areas like labor and environmental standards or more broadly help shape commercial behavior. Even the moves towards “friend-shoring” aren’t buttressed by trade agreements. And with the administration’s rejection of the WTO decision on steel and aluminum tariffs, it’s not even giving weight to the rules-based order it claims to protect.

A lot of this is probably due to broad skepticism with free trade among key Democratic stakeholders like labor unions and environmental groups and a more general skepticism towards corporations. That’s fine (even if the decline of the U.S. welfare state bears more blame for any employment shocks from free trade and even though solid majorities of Americans in both parties and in general support free trade), but firms are still the ones doing the day-to-day business of trade and it’s their decisions that will determine the shape of globalization to come.

Ultimately, the Biden administration has created an artificial tension between national security and rules-based governance – artificial, because legitimizing the international organizations and rules that govern all of this would go farther towards supporting the international system than export controls on their own. Globalization and the international trading system didn’t emerge at the whim of decision makers, but through innovation and private sector behavior – the same factors that will decide globalization’s future. States can help shape that behavior, but doing so requires a willingness to use the full range of geoeconomic tools and a lot of patience, neither of which Washington seems to have in reserve these days.

Disclaimer: The views expressed in this IOG Economic Intelligence Report do not necessarily reflect those of the API, the Institute of Geoeconomics (IOG) or any other organizations to which the author belongs.

API/IOG English Newsletter

Edited by Paul Nadeau, the newsletter will monthly keep up to date on geoeconomic agenda, IOG Intelligencce report, geoeconomics briefings, IOG geoeconomic insights, new publications, events, research activities, media coverage, and more.

Visiting Research Fellow

Paul Nadeau is an adjunct assistant professor at Temple University's Japan campus, co-founder & editor of Tokyo Review, and an adjunct fellow with the Scholl Chair in International Business at the Center for Strategic and International Studies (CSIS). He was previously a private secretary with the Japanese Diet and as a member of the foreign affairs and trade staff of Senator Olympia Snowe. He holds a B.A. from the George Washington University, an M.A. in law and diplomacy from the Fletcher School at Tufts University, and a PhD from the University of Tokyo's Graduate School of Public Policy. His research focuses on the intersection of domestic and international politics, with specific focuses on political partisanship and international trade policy. His commentary has appeared on BBC News, New York Times, Nikkei Asian Review, Japan Times, and more.

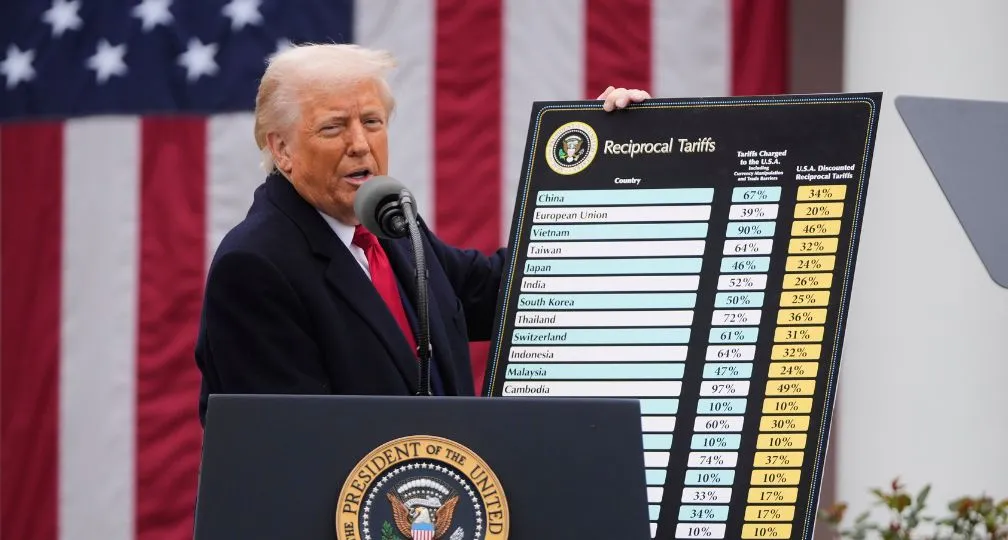

View Profile The Big Continuity in Trump’s International Economic Policy2025.06.11

The Big Continuity in Trump’s International Economic Policy2025.06.11 From dollar hegemony to currency multipolarity?2025.06.25

From dollar hegemony to currency multipolarity?2025.06.25 The Lessons of the Nippon Steel Saga2025.07.08

The Lessons of the Nippon Steel Saga2025.07.08 The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09

The Tyranny of Geography: Okinawa in the era of great power competition2024.02.09 Trade, capital flows, and the new focus on “global imbalances”2025.05.27

Trade, capital flows, and the new focus on “global imbalances”2025.05.27